Form 5498 is used to report contributions to IRAs (including deemed IRAs within a qualified plan), and certain other IRA-related information, including fair market value and required minimum distributions. Form 1099-R is used to report designated distributions from retirement plans, annuities, IRAs, and other sources.

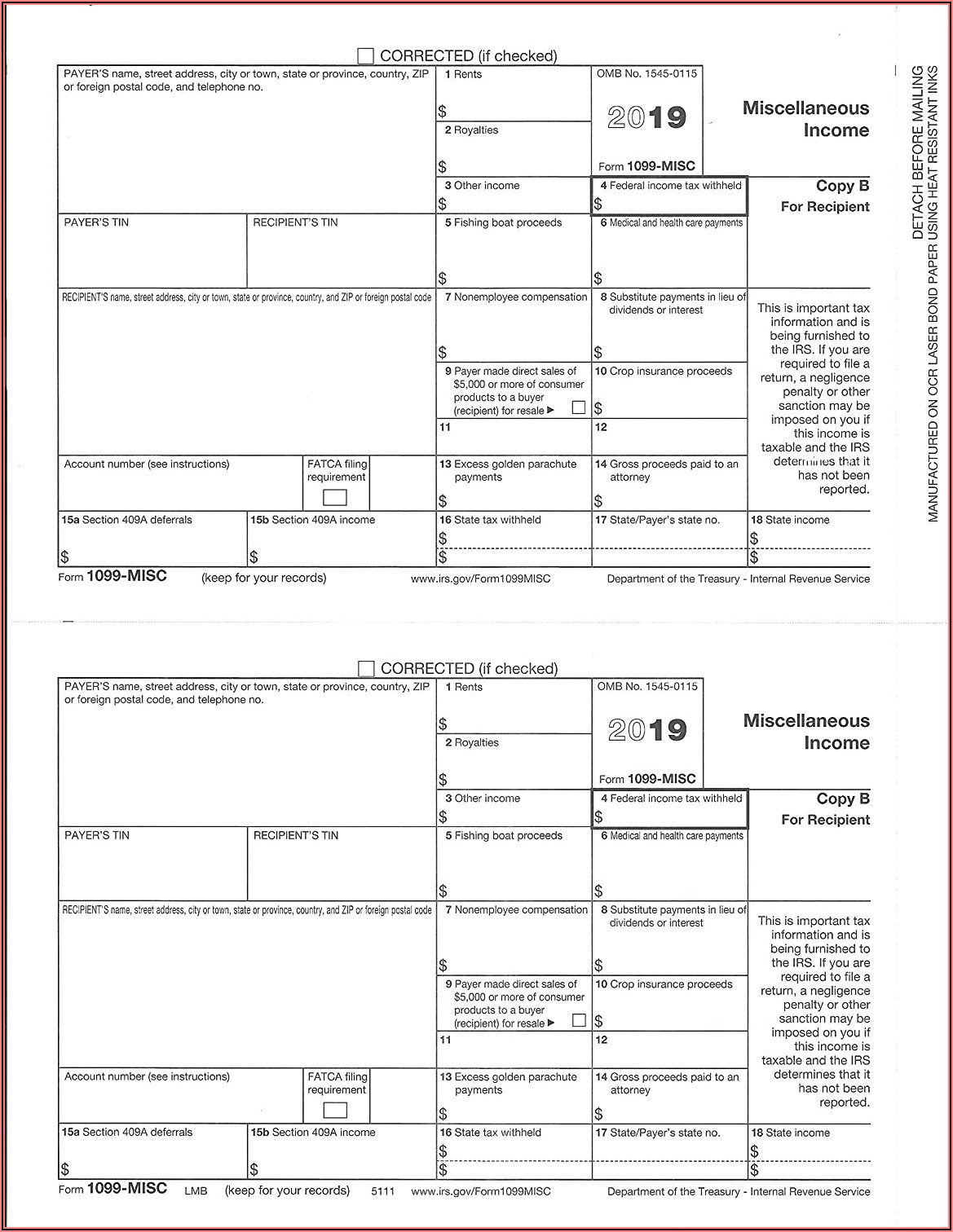

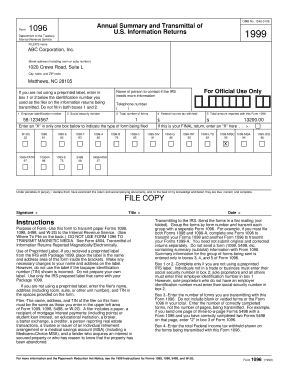

The IRS has released the 2021 versions of Forms 1099-R and 5498, their combined instructions, and the general instructions that explain how to file these and various other IRS forms. We typically respond within 24 hours.IRS Form 1099-R (Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.) (2021) IRS Form 5498 (IRA Contribution Information) (2021) Instructions for Forms 1099-R and 5498 (2021) General Instructions for Certain Information Returns (Forms 1096, 1097, 1098, 1099, 3921, 3922, 5498, and W-2G) (2021) Note: Actual 1099-MISC forms are not included and may be ordered at no charge from the IRS Employer Returns website here.Ĭost is $4.75 for the template for your personal or business use.įor any questions, comments, or concerns, please contact us via the Contact Us page.

Template uses 12-point Courier font as required by IRS guidelines.

0 kommentar(er)

0 kommentar(er)